31+ take home pay calculator maine

By using Netchexs Maine paycheck calculator discover in just a few steps what your anticipated paycheck will look like. Web The salary calculator converts your salary to equivalent pay frequencies including hourly daily weekly bi-weekly monthly semi-monthly quarterly and yearly.

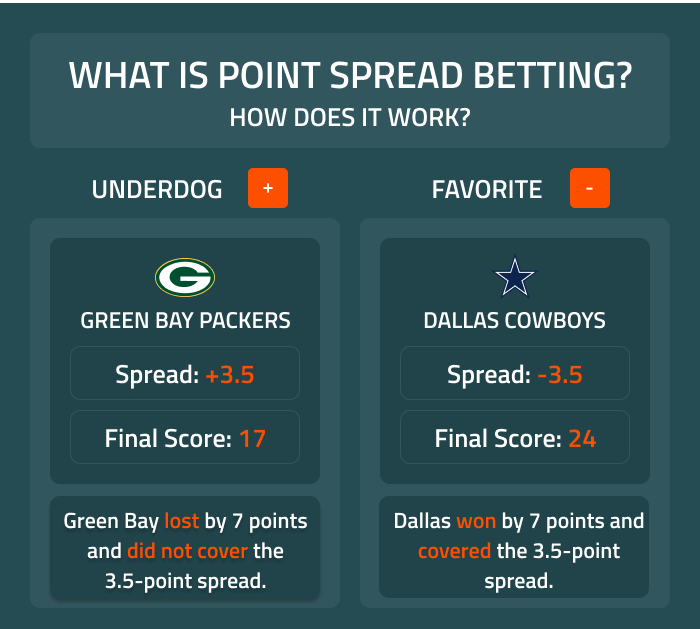

What Is Spread Betting Point Spreads Explained

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators.

. This income tax calculator can help estimate your average income tax rate and your take home pay. 0 to 54 on the first 12000 in wages paid to each employee in a calendar year. If youre a new employer congratulations you pay a flat rate of 245.

Hours Per Day Days Per Week Starting Pay Hourly Pay Exclude un. Are you a resident of Maine and want to know how much take-home pay you can expect on each of your paychecks. There you have it.

This calculator is intended for use by US. Web Maine Income Tax Calculator 2022-2023 If you make 70000 a year living in Maine you will be taxed 11500. Web As an employer in Maine you have to pay unemployment insurance to the state.

State Date State Maine. Maine has a progressive income tax system with rates ranging from 580 to 715. This Maine hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Customize using your filing status deductions exemptions and more.

The total taxes deducted for a single filer are 101026 monthly or. Well do the math for youall you need to do is enter the applicable information on salary. Web A single filer in Maine who earns 57000 per annual will take home 44877 after taxes.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maine. See payroll calculation FAQs below. The rate ranges from.

Web Salary Paycheck Calculator Maine Paycheck Calculator Use ADPs Maine Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Your average tax rate is 1167 and your marginal tax rate is 22. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Web Maine Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Web To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Married filers no dependent with a combined annual income of 114000 will get 89754 after taxes. Web Maine Income Tax Calculator - SmartAsset Find out how much youll pay in Maine state income taxes given your annual income.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How much taxes are deducted from a 57000 paycheck in Maine. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Customize the salary calculator by including or excluding unpaid time such as vacation hours or holidays. These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Web By inputting your period or annual income together with the required federal state and local W4 information use our free Maine paycheck calculator to determine your net pay or take-home pay.

Web The state income tax rate in Maine is progressive and ranges from 58 to 715 while federal income tax rates range from 10 to 37 depending on your income. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to 715. Web How to Calculate Your Paycheck in Maine.

It can also be used to help fill steps 3 and 4 of a W-4 form. Switch to Maine salary calculator. Web The Maine Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Maine State Income Tax Rates and Thresholds in 2023.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

University Of Maine The Princeton Review College Rankings Reviews

305 Old Bay Rd Bolton Ma 01740 Mls 72763898 Redfin

The Population Mean Explanation Examples

Maine Salary Paycheck Calculator Gusto

77 000 After Tax 2022 2023 Income Tax Uk

Pdf Non Market Valuation Using Stated Preferences Applications In The Water Sector

1462 Mcgregor Rd Vanderbilt Mi 49795 Realtor Com

67 Fairview Rd Monterey Ma 01245 Realtor Com

3228 French Rd Alpena Mi 49707 Zillow

Vgvzfwt6wmdctm

Free Maine Payroll Calculator 2023 Me Tax Rates Onpay

Homebuyer Help How To Find A Buyer S Agent In The Dmv Ask These Tough Interview Questions Buyer S Edge Buyersagent Com Real Estate For Homebuyers

304 South St Cheboygan Mi 49721 Zillow

Maine Salary Calculator 2023 Icalculator

Panniers Vs Bikepacking Bags Bikepacking Com

Medical Coding Salary Medical Billing And Coding Salary Aapc

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Crown Village Apartments 445 North Volland Street Kennewick Wa Rentcafe